Services for NGOs

The CAGI assists international non-governmental organizations (NGOs) already established or seeking to do so in the Geneva region.

- Home

- Services

- Services for NGOs

- Social insurances

Social insurances

Information on social insurance and other compulsory contributions in Switzerland, as well as levels of contribution by the employee and the employer.

Health insurance provides benefits in the event of illness, accident (if no accident insurance covers it) and maternity. It is compulsory, so anyone domiciled in Switzerland must take out health care insurance within three months of taking up residence or being born in Switzerland.

Accident insurance (AA in French) is compulsory for all employees working in Switzerland. They are compulsorily insured against work-related accidents and illnesses. A person is considered to be an employee when they carry out a dependent gainful activity as defined by the AVS. It is optional for the self-employed. Are also compulsorily insured:

- people who work from home,

- apprentices,

- interns,

- volunteers (charity work),

- people working in trade schools or sheltered workshops,

- persons exercising an activity with an employer for the purpose of choosing a profession (professional orientation course).

The accident insurance (AA) compensates for damage suffered in the event of illness for professional reasons or a professional accident. The AA provides benefits in the form of medical treatment and financial support.

Premiums for compulsory insurance against occupational accidents and diseases are paid by the employer; those of the compulsory insurance against non-occupational accidents are the responsibility of the employee. The employer deducts the latter’s share from the salary and pays all the premiums. Premiums vary according to the income of the insured and the type of business.

Contribution to the following social security schemes is compulsory:

- Old-age and survivors’ insurance (AVS).

- Disability insurance (AI).

- Income compensation allowance (APG).

- Unemployment insurance (AC).

- Family allowances (AF).

- Cantonal maternity insurance (AMat).

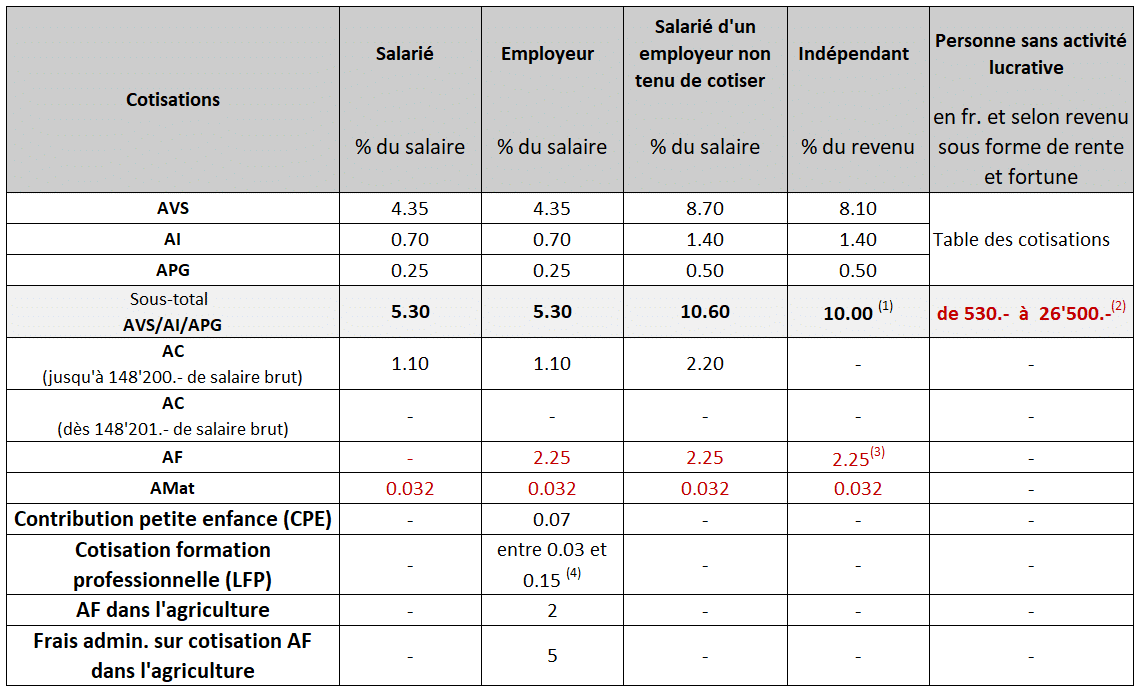

AVS / AI / APG / AC / AF / Amat contribution: status as of 1 January 2025 of the following indicative rates ( reference: Office Cantonal des Assurances Sociales ):

(1) Si le revenu annuel est inférieur à 60’500 francs, un barème dégressif s’appliquera aux taux de cotisations

(2) Montant annuel à payer réparti en quatre versements

(3) Cotisations calculées sur le revenu soumis à l’AVS/AI/APG, jusqu’à un revenu annuel déterminant de 148’200 francs

(4) Dégressive en fonction de la masse salariale 2024 :

- 0.082% pour une masse salariale jusqu’à 2,5 millions de francs

- 0,065% pour une masse salariale comprise entre 2,5 et 10 millions de francs

- 0,0497% pour une masse salariale comprise entre 10 et 50 millions de francs

- 0,0396% pour une masse salariale dès 50 millions de francs

The AVS is the main pillar of old-age and survivors’ pensions in Switzerland ( 1st pillar). The AVS is compulsory and is intended to cover the vital needs of an insured person in the event of retirement or death.

Non-occupational accident insurance covers the financial consequences of accidents that do not take place at work. All employees active in Switzerland are compulsorily insured against non-occupational accidents, home-to-work travel included, if they work at least 8 hours per week with the same employer. The latter may demand the premiums for non-occupational accident insurance from their employee.

For employees who work less than 8 hours per week, non-occupational accidents are not insured (exception: for these employees, accidents on the home-work journey are insured with the occupational accident insurance). However, to be well covered, these people must insure the risk of accident with their compulsory health insurance fund.

Military insurance covers costs in the event of illness or accident occurring during missions in the service of security and peace. The activities insured are military service and civil protection, civil service, actions in the Swiss humanitarian aid corps, peacekeeping actions and assistance of the Confederation.

Military insurance covers the costs of treatment in the event of illness and accident as well as the costs resulting from rehabilitation measures; it allocates daily allowances and annuities in the event of loss of earnings and covers the risks of disability and death. These services are financed by the budget of the confederation and are not subject to any obligation to contribute.

Occupational pension (PP) is the 2nd pillar of social insurance. It must give the insured the possibility of maintaining in an appropriate manner their standard of living prior to retirement. The objective of the PP is to reach – by adding the PP to the AVS/AI pension – 60% of the last salary.

In addition, the 2nd pillar covers the risks of death and disability. Any employee also insured for AVS who receives an annual salary of more than 21,510 francs from the same employer is insured under the PP.

There is also private provision, which encourages individual savings. It is not compulsory and is complementary to the AVS and to the 2nd pillar.

Cross-border teleworking

People living outside Switzerland who telework for an employer based in Switzerland may find their social security and tax situation affected. The applicable regime depends in particular on the percentage of teleworking carried out from the country of residence and on the potential agreements concluded between Switzerland and the country of residence.

It is therefore essential to be well informed to avoid any surprises or non-compliance. For a detailed explanation of the legal regime applicable to cross-border teleworking, please consult the page dedicated to teleworking on the Fédération des entreprises romandes (FER) website (FR).

Member of CAGI

Other useful information

to recruit and employ staff

CAGI Recruitment Platform

Hiring assistance

Internships

Swiss labour law

Tax regime for employees

Volunteering

Work permit and visa

Young professionals agreements

CAGI services

for NGOs and Permanent Missions

Contact

By appointment only: Monday to Friday from 9 am to 12 pm / 2 pm to 4:30 pm

La Pastorale: Route de Ferney 106, 1202 Genève

Access by public transports (TPG): Line 5: stop Intercontinental; lines 8, 20, 22, 60: arrêt Appia. No parking on site.

Founded by the Swiss Confederation and the Republic and Canton of Geneva, the International Geneva Welcome Centre is the single entry point for the support and integration of employees of International Geneva and their families, NGOs and visiting delegates.